As the marketplace administrator, it is important to provide merchants the option to charge taxes on sales and report and remit those taxes if need be. Arcadier helps in complying with tax laws and regulations by making a Sales Tax plugin available within the platform. Essentially, the plug-in allows merchants to add any kind of tax, e.g. Sales Tax/VAT/GST, to their products. It can be inclusive or exclusive in the cost displayed to the customer. Automatically generated emails can have the tax breakdown included in them.

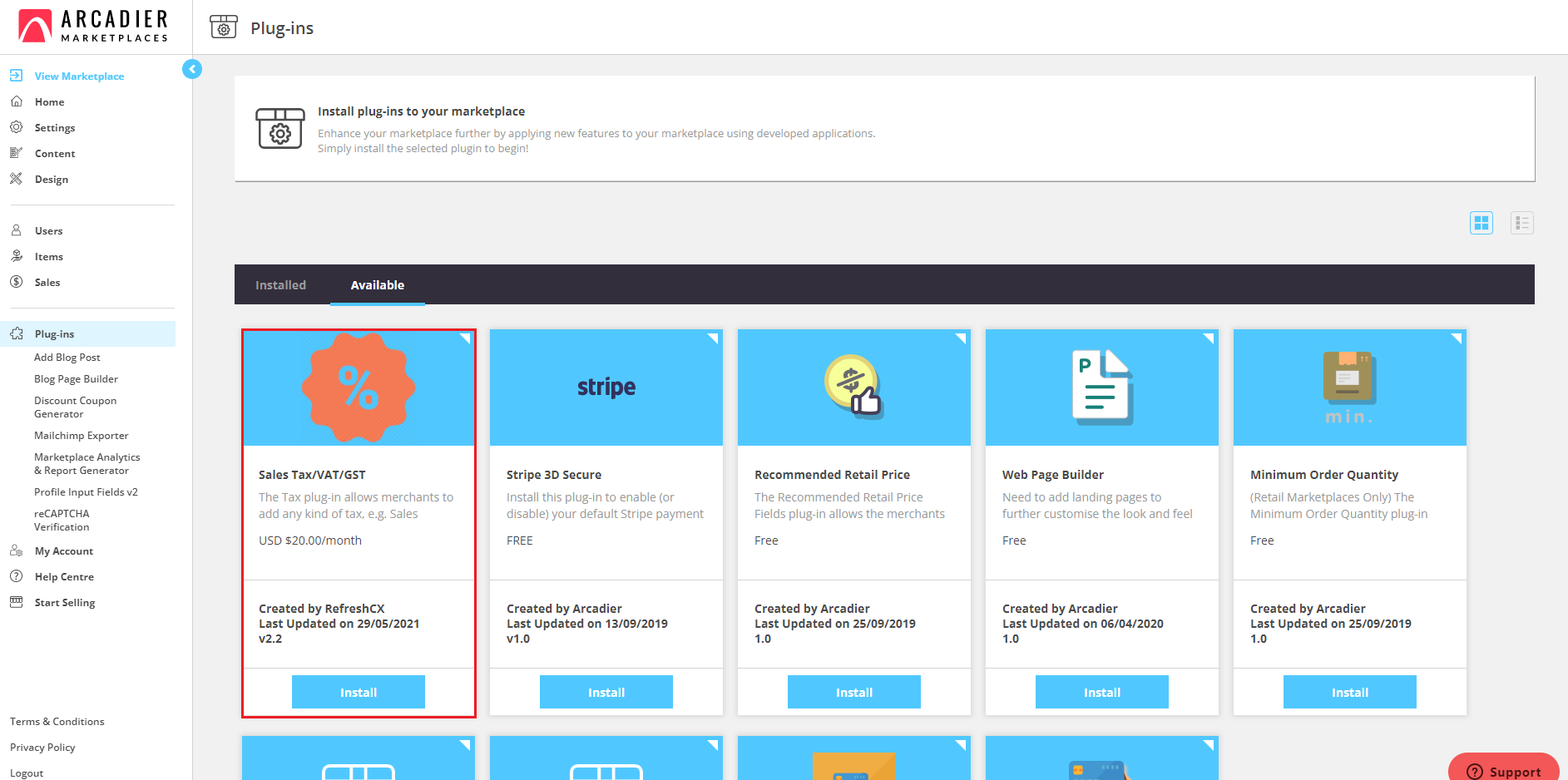

To install the plugin, simply head to the Plugins tab in your admin portal. Then, find the Sales Tax plugin under the Available options and click the Install button. See the image below for reference.

To learn more about the plugin, you can browse through these FAQs.

Q: What is the tax plug-in for?

A: For any percentage-based taxes, the plug-in will display tax information and applicable taxes at checkout.

Q: What is Inclusive vs Exclusive Pricing?

A: Inclusive pricing is where the price includes the tax. E.g., 10% GST in Australia will be automatically deducted from the price and shown to the customer at checkout. Exclusive pricing is where the tax is on top of the amount shown. E.g., a 20% VAT in the UK will be automatically added to the price and shown to the customer at checkout.

Q: Will the tax apply to all products?

A: Yes or No, you can choose. The individual merchants in the marketplace can select the taxes that apply, and the products that those taxes apply to. This is especially useful if your marketplace supports merchants in different countries where tax regimes may be different.

Q: Will the tax apply to all transactions?

A: Yes. Once a tax is set up, it will apply to all transactions. Please contact RefreshCX if any further business rules need to be applied and we can amend this at a nominal cost.

Q: When is the tax calculated?

A: The tax will be calculated at the checkout when all the costs including shipping (if applicable) are known.

Q: When is the tax applied?

A: The tax will be applied at the checkout when all the costs including shipping (if applicable) are known. This will reflect in the transaction in Arcadier, and the invoice that gets sent to the customer. There are custom transaction confirmation emails that will also break down the Net (excluding tax) and Gross (including tax) amounts.

Q: How many taxes can be set up?

A: Merchants can setup up to 5 different taxes and surcharges based on their needs. If more taxes are required due to the breakdown of multiple taxes, or by county jurisdictions, more tax rates can be added at a nominal cost based on your requirements. Please contact RefreshCX if 6 or more taxes are needed.

Q: Will the tax be available to all merchants?

A: By default, merchants can add their own taxes, however, we can add universal taxes at a nominal cost based on your requirements.

Q: Will the tax be shown in the product listing?

A: By default, the tax will not be shown in the product listing as the legal requirements are not known. This can be added at a nominal cost based on your requirements.

Q: Will the tax automatically apply to different countries?

A: The tax is controlled by the merchant. What they chose to enter will determine what is shown. By default, the tax will not be automatically applied to different countries. Location-based taxation can be added at a nominal cost based on your requirements.

Click here for more information on the plug-in.

For further questions and clarification, you can drop an email at sk@refreshcx.com