Understanding how transactions go through on your marketplace is an important part of ensuring your marketplace runs smoothly.

Tax and additional fees

Depending on the country of the buyer and seller, there may be taxes like GST and VAT. Sellers on the marketplace will have to include all payable cost into their final price as stated on the marketplace. This can include taxes and any other compulsory fees.

Invoice ID & Order ID

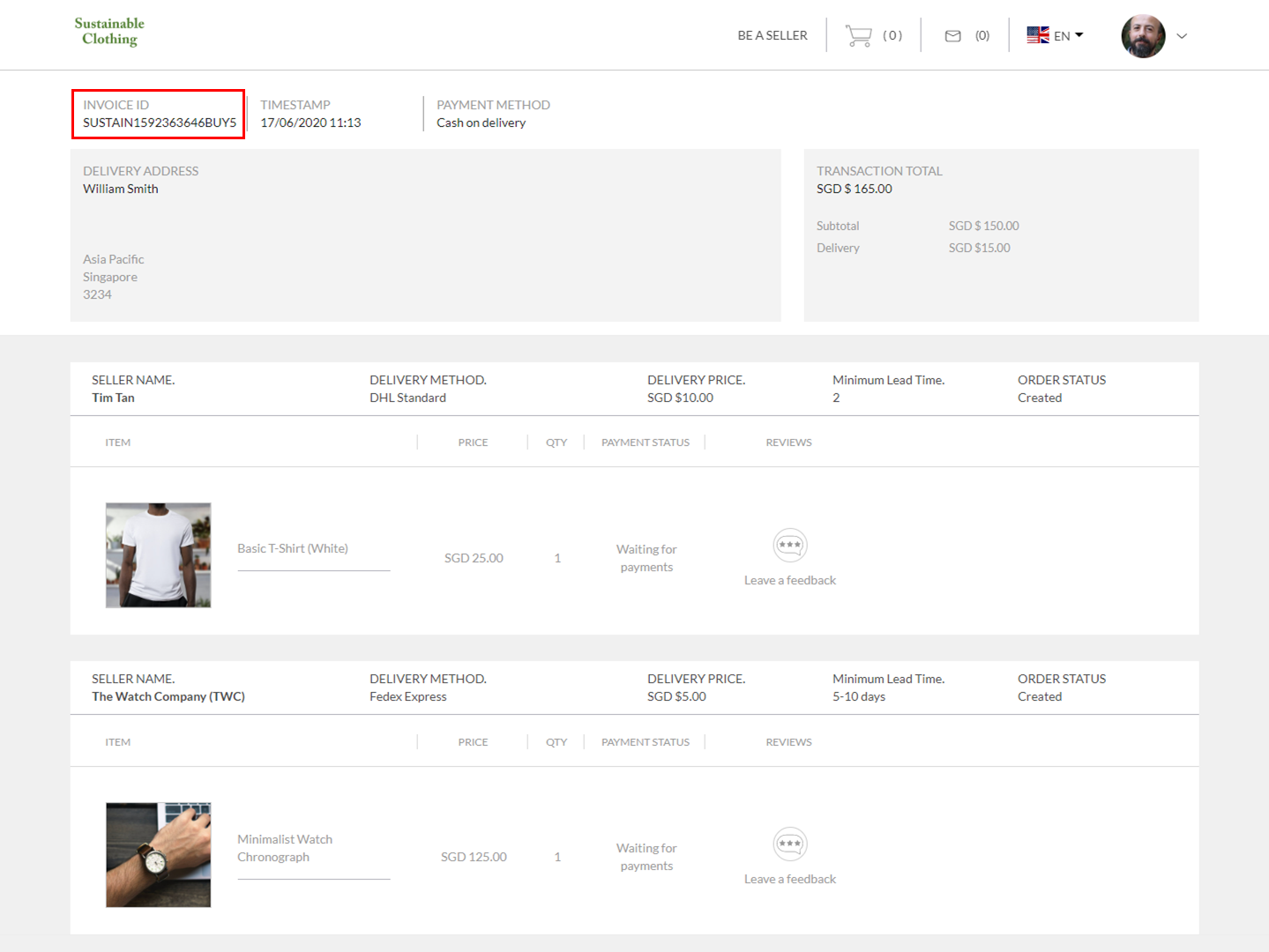

When a buyer purchases an item or a listing on the marketplace, an invoice ID will be generated. An invoice ID is a number generated after every successful checkout by a buyer. A particular invoice ID may include multiple items from multiple sellers bought from a single checkout by the buyer. In the example below, a buyer purchased from 2 different merchants and was given an invoice ID "SUSTAIN1592363646BUY5"

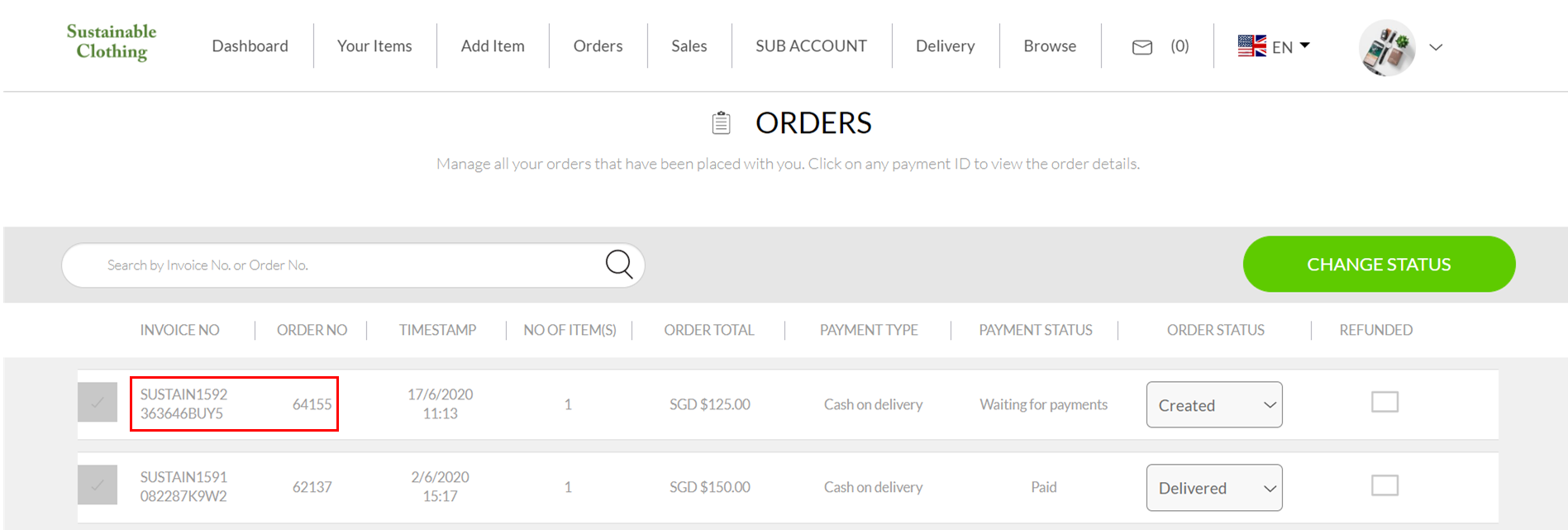

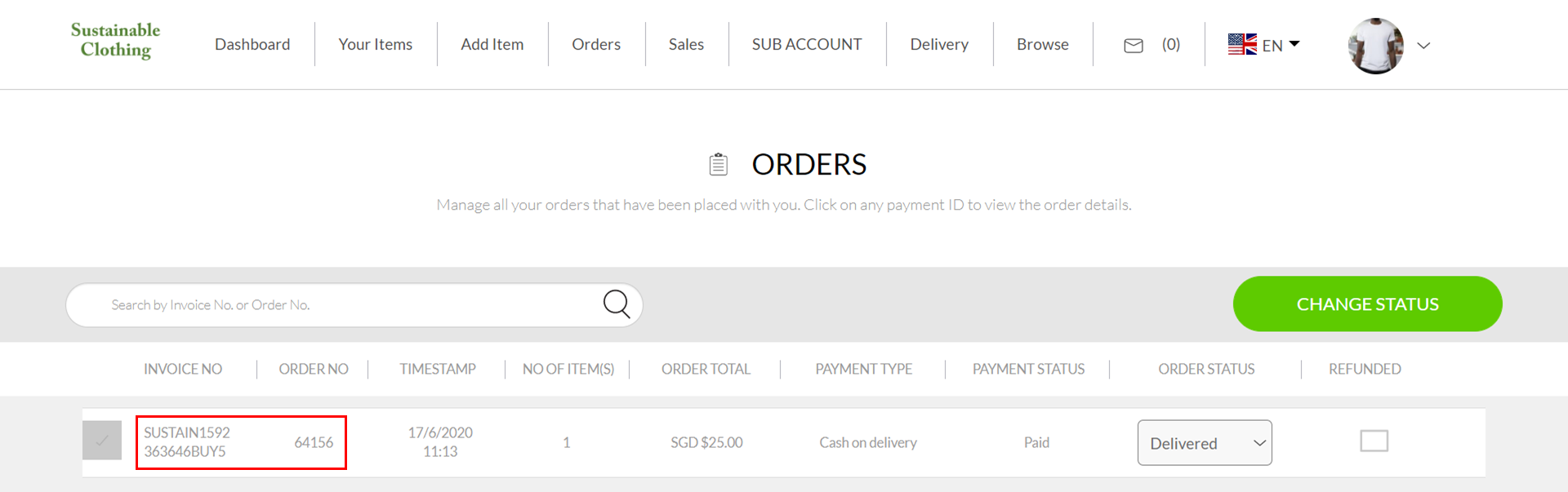

For every successful checkout with a single invoice ID, all purchased items made from the same particular seller will be consolidated to an order ID. In the example below, both merchants have received an order from the same invoice number "SUSTAIN1592363646BUY5". However, the first merchant's order ID is "64155" while the 2nd merchant's order ID is "64156". Thus, if a buyer purchases multiple items from multiple sellers, there will be one invoice ID and many order IDs.

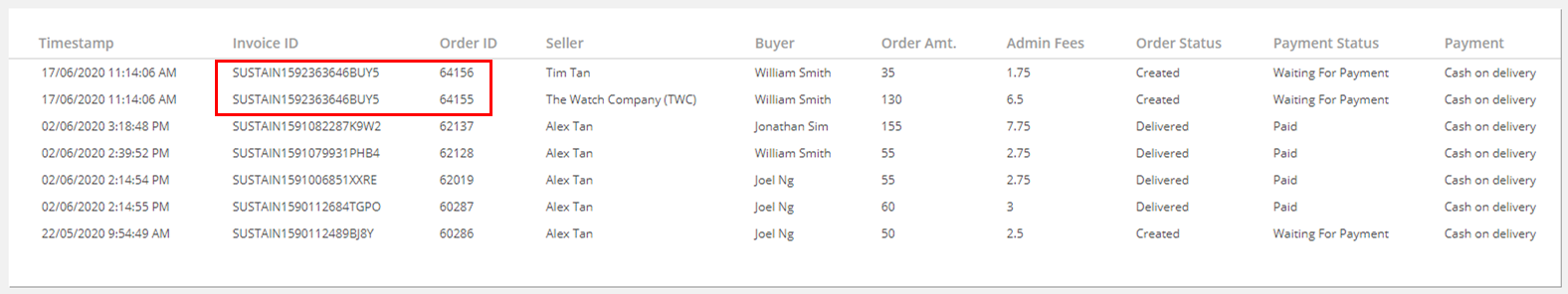

From the Marketplace Admin dashboard, admins will be able to see the invoice ID and the respective Order ID.

All transactions occur instantaneously on the marketplace using the payment methods set out by the admin. Payment can be delayed to the seller using alternative workaround methods such as using a generic payment processor or PayPal (via neutral fund). For more information on using a generic payment processor, you can refer to this article here.